This is a sponsored post, which means I was compensated for my time and talent in writing it. I was also provided access to Beyond Personal Finance for free. As always, all opinions are my own.

When we started homeschooling, I knew that strong academic skills were important to me. But my desires for my children went beyond just strong academic skills. There are many other skills I wanted them to learn – and one of those things was life skills.

While I don’t always love the phrase “well-rounded,” it is important to me that my kids have the skills they need as they grow older. Things like cooking, taking care of your belongings, and finances all help to shape them into the adults that they’ll someday be.

Even with this desire to teach them about finances, I have to admit the idea of teaching them about finances didn’t thrill me. I have a complicated relationship with money and teaching them about money without putting all my own baggage on it, is, well – complicated, quite frankly.

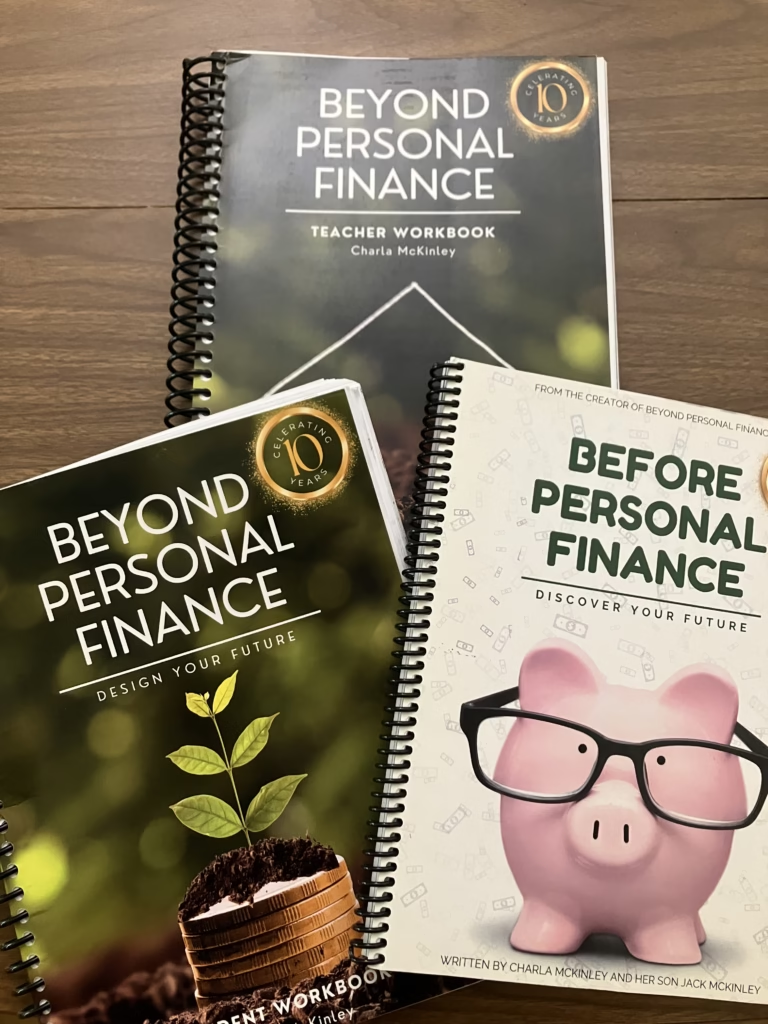

But that was before I discovered Beyond Personal Finance. I was thrilled when I first learned about them because from everything I heard, they seemed like a solid and fun option. So I purchased the tween curriculum, Before Personal Finance, and we got started. As my kids aged, I was curious about what the next level would look like and so it was very exciting to get to try Beyond Personal Finance.

Below, I’ll tell you why we love Beyond Personal Finance and give you a breakdown comparing the two levels to help you figure out which level is right for your kids.

What are Before Personal Finance and Beyond Personal Finance?

Before Personal Finance and Beyond Personal Finance are both designed to help your kids learn important personal finance skills through activities that mimic things you might do in real life. Kids practice budgeting, think about future jobs and how much money they might earn, learn money related terms and more.

Before Personal Finance is aimed at tweens and focuses on their future money choices from 13-22. Beyond Personal Finance is aimed at teens and focuses on their future money choices from 22-42.

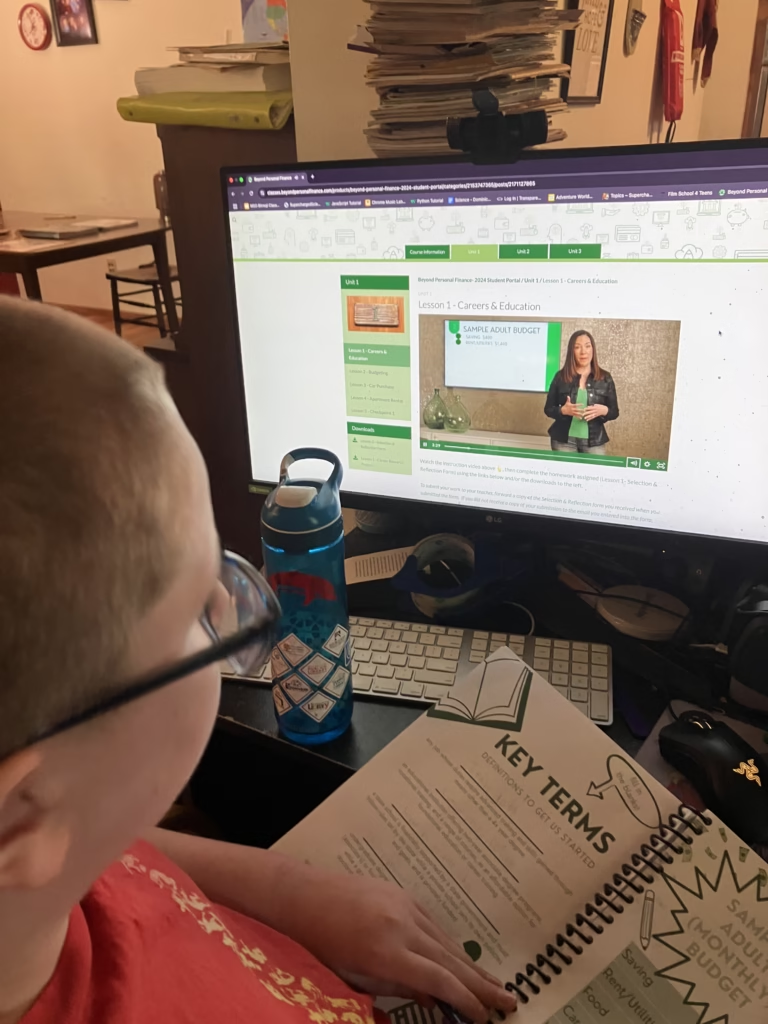

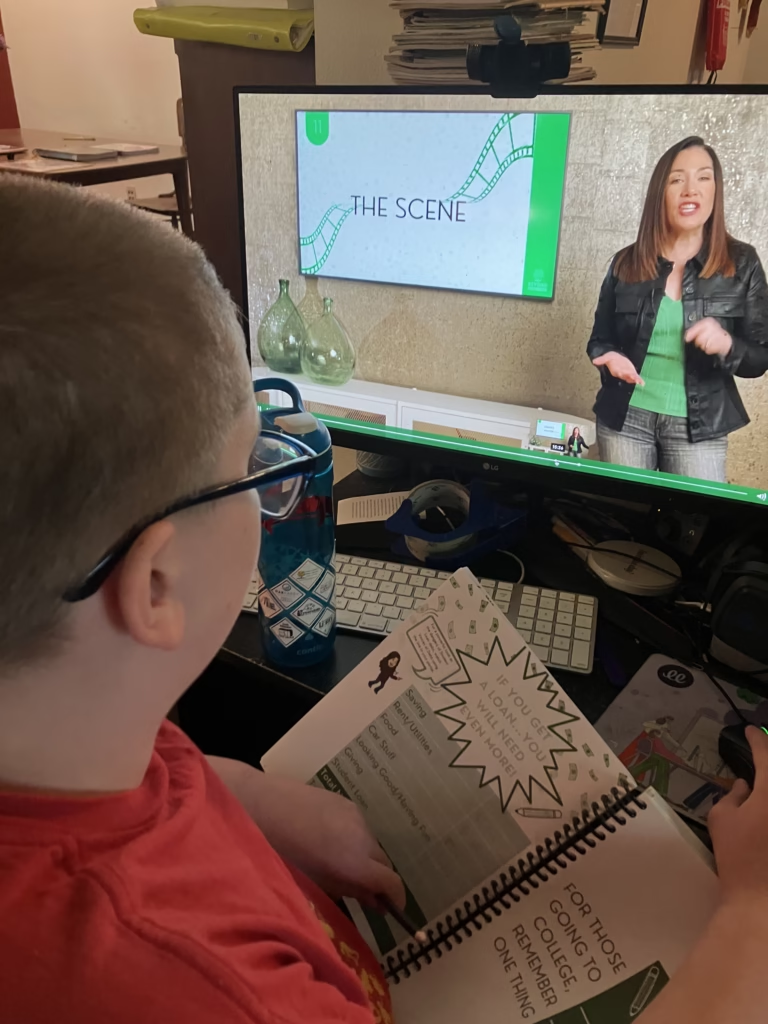

Both come with a workbook, but the teen level also has a student portal and video lessons. Both are interactive, but the teen level involves more online resources in that interaction (though the tween level does still include some).

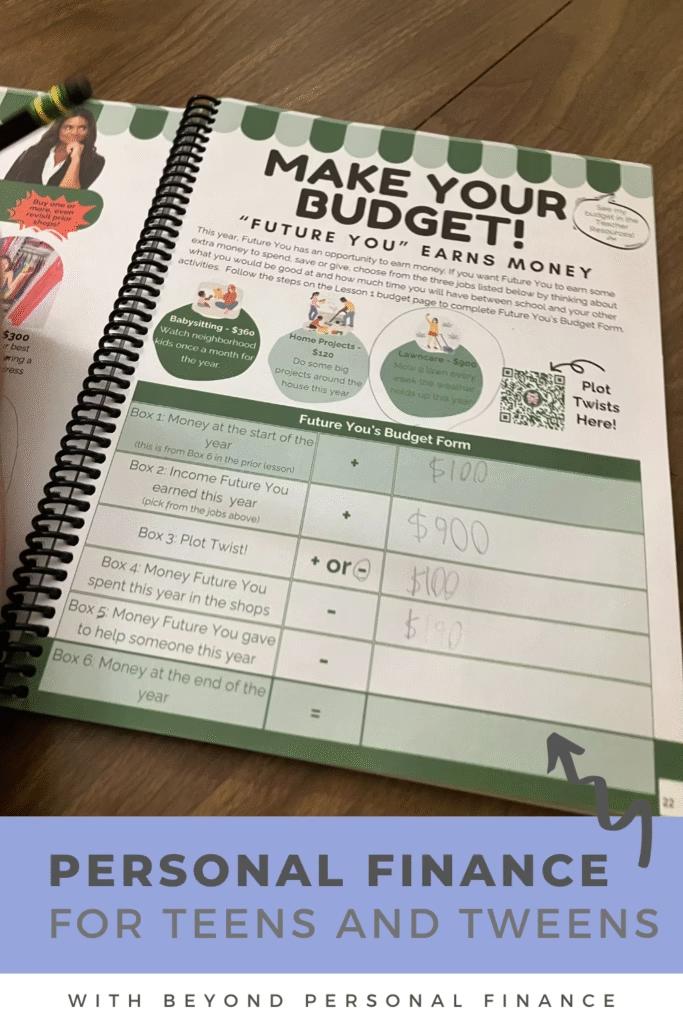

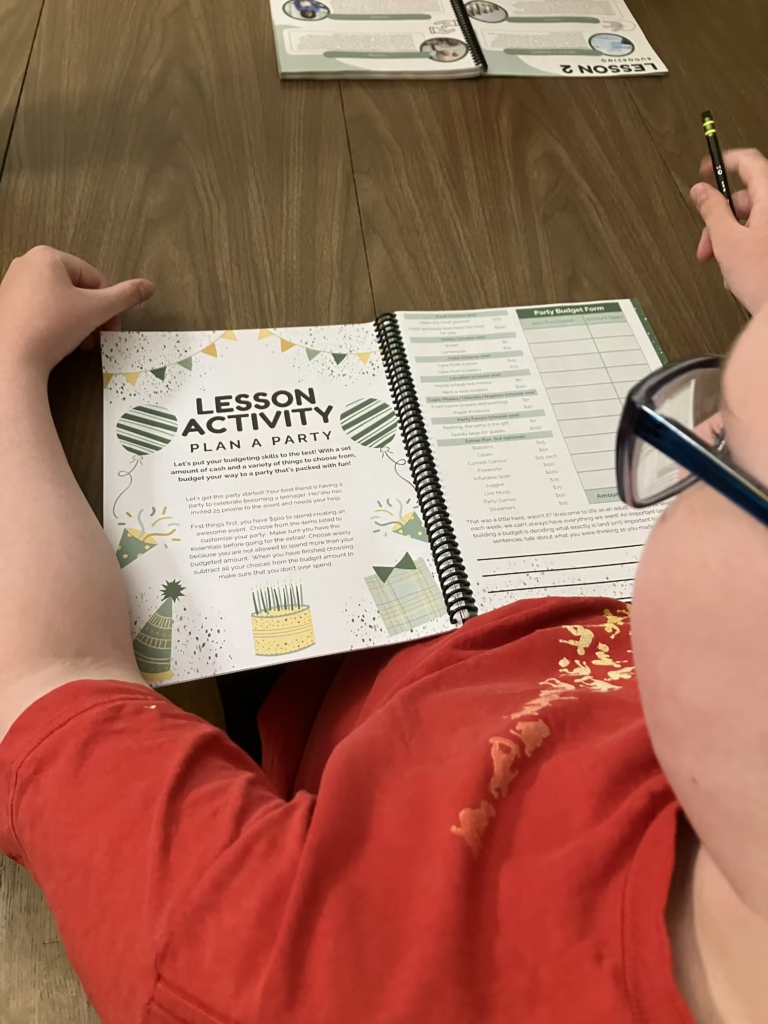

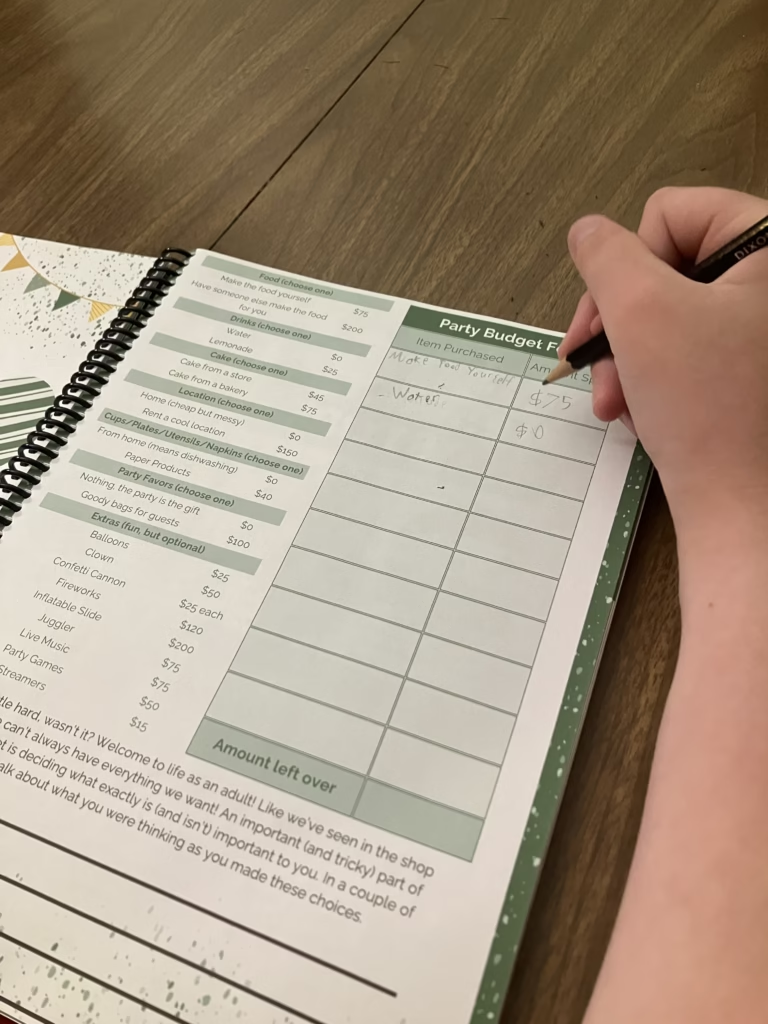

Before Personal Finance is more basic – not in quality, but in content. It spends time every lesson teaching basic money terms. Every lesson also includes an activity – some of which are based on activities they might do in real life, like planning a party. It also includes a budget activity – where they have to make choices like what they should buy and how they will earn money. Plus, every budget includes plot twists – which can be good or bad unexpected events. I really like how this activity carries over from lesson to lesson, showing how saving or spending can really compound over time.

Lessons usually also include some kind of puzzle, like a word search or a maze, and they often highlight a famous person connected to money or the economy. Lessons then wrap up with a quiz and a reflection – getting students to think about the choices they made in this lesson.

Beyond Personal Finance really is the next level and the lessons reflect that. While they do start with key terms, right from the beginning these terms feel a step up from the terms in Before Personal Finance. Then, the pages of the lesson are followed along with the video lesson, helping your kids to answer the questions and think about them. This level also has more online resources. Every lesson has a virtual selection and reflection form for students to complete. This level also has a spreadsheet for them to fill out with every lesson. The budget in Before Personal Finance is pretty basic, but the budget in Beyond Personal Finance has them thinking about more, like insurance, taxes, and other grownup things. Apart from the virtual resources, these are also available as PDFs. However, a nice benefit of using the virtual format is that it calculates the math for you! Beyond Personal Finance is definitely a step up in levels for your older teens who are getting ready to launch into the world.

Getting Started with Beyond Personal Finance

One thing that I really enjoyed about both Before Personal Finance and Beyond Personal Finance is just how easy they were to get started in. Each had a video that walked you through how to use the program. Before Personal Finance also has a Teacher’s Corner in every lesson, which is a brief one-page note about the lesson and what your child will be learning in that lesson. Beyond Personal Finance doesn’t have that, but I think it assumes a certain level of independent work on the part of your teen.

The answer key for Before Personal Finance is available online; the answer key for Beyond Personal Finance is available as a teacher workbook. However, I think for the most part, the answers are able to be figured out by you even without the answer key. (I often am able to figure out the answers without the answer key. However, I do appreciate having them in order to to check their work faster.)

Beyond Personal Finance Encourages Conversation Among Families

One thing that I really appreciate about both levels is that they do a good job of encouraging families to talk about money. They really encourage parents to share examples from their own life and their own experiences with money.

In many families, money can be such a taboo topic. It’s great that Before Personal Finance and Beyond Personal Finance encourage families to be open about this important subject. If you (the parent) weren’t raised to talk about money, this curriculum will give you an easy way to start discussing it with your kids.

Beyond Personal Finance is Grounded in Real World Experiences

All throughout this curriculum, real world experiences and examples are wove throughout. I love this because I think it shows kids how they will use these skills in real life. I think that’s what moves a curriculum beyond just being a math curriculum into a comprehensive personal finance curriculum. These aren’t just word problems. They are a true invitation to your children to consider the way money works in their personal life.

Some real world scenarios it invites your child into:

- Making decisions about college, careers, and student loans

- Party planning

- Buying a car (plus insurance)

- How to write a check

- Renting an apartment

There are even more than these. I just wanted to give you a flavor of the real world scenarios it invites your kid to consider.

Having to think through these real world scenarios helps kids in their journey to become independent learners.

Fun Without Fluff

The interactive format invites your child to make lots of decisions about their own life. In their hypothetical budget, for example, would they rather make money by mowing lawns or babysitting? Maybe they’ll choose not to work a job but then when it comes to expenses they’ll be more limited.

The curriculum features interaction at every turn. Not only does this interaction make it more meaningful to kids, but it also makes it more fun. It was fun for me to look at my kids and see what kind of party they would plan. One of my kids was content with having a simple party. The other kid wanted to see how much he could maximize his party and still be within budget. The conversations with my oldest about his future career have been surprising. I hope this experiences helps him think as he heads towards high school about what comes next.

Beyond Personal Finance also features video lessons, which are engaging and substantive. They do a great job pulling teens in while still conveying a ton of information.

Which level is right for me?

If you have younger kids, I definitely recommend Before Personal Finance. This will help get them introduced to money basics. Plus, some of the activities are just a little too easy for an older kid.

If you have an older student, Beyond Personal Finance is the way to go. This is especially true if you are looking to get into some discussions about their plans after high school. I appreciated Beyond Personal Finance’s acknowledgment that there are many different paths you can take after high school. The curriculum also acknowledges that they all require hard work. I think it’s truly designed to prepare your kids to think about money and where it comes from. They’ll also start to think about how they’ll manage it in their adult life. The topics discussed in the course are naturally milestones teenagers are thinking about, like life after high school and buying a car. This course is also more self directed, so make sure your student is ready for that before you start.

Both levels would certainly be beneficial as they do kind of naturally build on each other. However, if you have a teen and you are wondering if you can go straight into Beyond Personal Finance, I would say yes. Even though they nicely compliment each other, they also stand on their own. It isn’t necessary to make your child go through the younger level if they are ready for Beyond Personal Finance.

Personal Finance is a Must Teach Subject for Your Homeschoolers

Even if we might be uncomfortable discussing it, money is such an important part of our society. Helping our kids to understand money now allows them to learn to make good decisions for the future. Before Personal Finance and Beyond Personal Finance give you an easy way to tackle this often taboo subject. As they learn, your kids will build the foundation they need. Plus, it’s interactive and fun for them too!

How do you ensure your kids have the personal finance skills they need as they grow?

Leave a Reply